The government of Malaysia is offering 50 income tax exemptions for three consecutive years 2018 2020 to individuals who rent out their residential properties at a rate not exceeding RM 2000 per month for each property. Without EPF deductions your income exceeds RM382025 per Annum or RM318352 per month.

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Set under a separate category rental income tax comes with its own progressive tax rates that range between 0 and 30.

. Technical fee rental of movable property payment to a non-resident public entertainer or other payments made to non-residents which are subject to Malaysian withholding tax but where the withholding tax was not paid. The tenants are entitled to use the swimming pool tennis court and other facilities that are provided in the apartment. Amount RM Individual chargeable income less than RM35000.

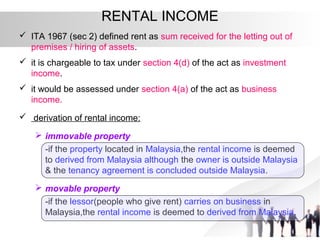

Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms. In Malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d Rental income of the Income Tax Act 1967. Gross rental income is US1500month.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. In order to promote affordable accommodation to the. Passive rental income is filed under Section 4 d of the Income Tax Act 1967 ITA.

So to reiterate only your net rental income will be taxed. Whether you are looking to buy or rent properties we have the most comprehensive property listings in Malaysia for all popular property. So the income depends on how much you earn per annum or monthly.

Income received from the letting of the real property is charged to tax as rental income under paragraph 4 d of the ITA. Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30. Whats the income tax on residential lettings in Malaysia.

The property is personally directly owned jointly by husband and. Rental income taxes. But lets say you did make a bit of profit is there still.

Income tax on rent worked example in Malaysia. Payment for accommodation at premises registered with the Commissioner of Tourism and entrance fee to a tourist attraction expenses incurred on or after 1 March 2020 until 31 December 2021 1000. Discover how much a foreign landlord earning rent will actually pay using worked examples.

Income from the letting of real property in Malaysia is named as rental income and is chargeable to tax under section 4 d of the. A company is tax resident in Malaysia if its management and control are exercised in Malaysia. Hence it is important for property investors to understand the actual taxation on rental income before they start to rent their property out.

If you had received RM24000 as rental income in one year but you spent RM26000 on permitted expenses this would be considered as a loss and you wont have to declare that RM24000 as rental income for that year. Prior to Jan 1 2018 all rental income was assessed on a progressive tax rate ranging from 0 to 28 without any tax incentive or exemption. This is after EPF deductions.

In Budget 2018 the government introduced a new limited time tax exemption designed to control home rental prices. Under the Income Tax Act. You will only need to pay tax if.

However those rental income are taxable based on Malaysia Taxation Law. The amount of income you earn exceeds RM34000 per Annum and if you break it down to per month around RM283333. Azrie owns 2 units of apartment and lets out those units to 2 tenants.

It is also calculated on a net basis where all claimable expenses can be deducted. Monthly Rental Income 2. The tax levied on the average annual income on a rental apartmentproperty in the country.

The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. Taxation Researcher February 04 2019 Non-resident couples rental income 1. According to Thannees Tax Consulting Services Sdn Bhd managing director SM Thanneermalai there are two types of rental income namely passive and business income.

Special Tax Deduction On Rental Reduction

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

8 Things To Know When Declaring Rental Income To Lhdn

Computation Of Buss Income Computation Of Statutory Business Income For Ya Rm Net Profit Before Studocu

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rent Income Excel Template Online Tax File Rent Expense Etsy New Zealand

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Taxation Principles Dividend Interest Rental Royalty And Other So

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Global Rental Income Tax Comparison

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

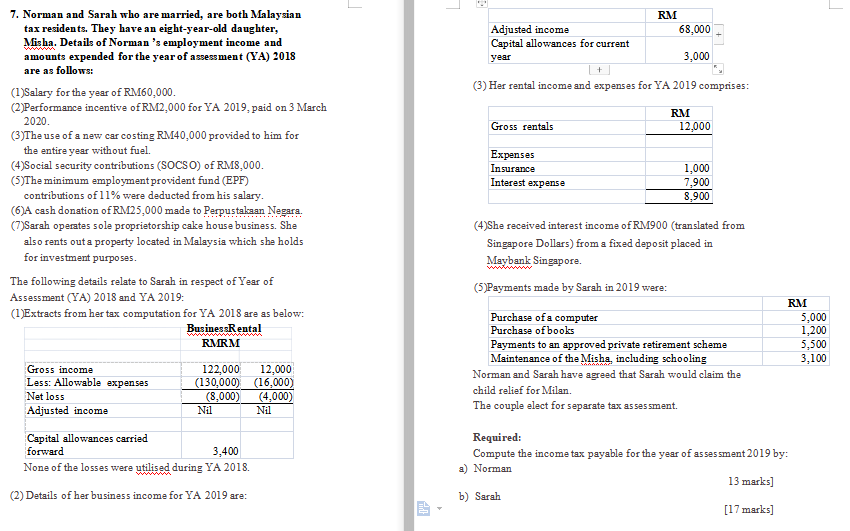

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

.jpg)